“How Much Should I Set Aside for Taxes?” — A Realtor’s Guide to Smart Withholding & Cashflow

A Realtor’s Guide to Smart Withholding, Quarterly Planning & Cashflow Survival

🎯 Why This Matters

Every commission check feels like freedom — until tax season hits and the IRS (and your state) come calling.

Most agents are independent contractors, meaning no one withholds taxes for you. If you don’t plan, that next “big check” can turn into a big surprise.

The good news? You can soft calculate your tax set-aside each time you get paid and stay ahead of your quarterly payments — no spreadsheets required.

🧮 Step 1: How to Soft-Calculate Your Tax Withholding

Your tax withholding depends on two key factors:

1️⃣ Your business structure (sole proprietor vs. S-Corp)

2️⃣ Your state’s income tax rate

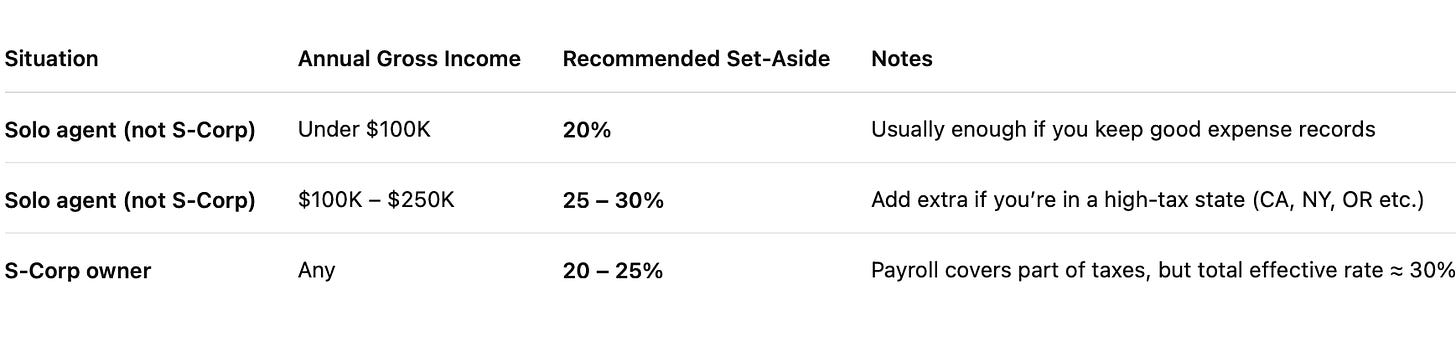

🧾 Federal + State Combined Rule of Thumb

Payroll covers part of taxes, but the total effective rate ≈ is 30%

💡 Pro Tip: Don’t forget state taxes.

California can easily add 8 – 10% to your total tax rate.

Florida agents, for example, enjoy no state income tax, so they can safely stay within the 20–25% range. Also, if you are earning more than 60K Net in your pocket, please consider setting up an entity and electing to be taxed as an S corporation.

💰 Example

You close a $10,000 commission in California:

25% set-aside = $2,500 → move it immediately to a separate “Tax Savings” account.

Use a bank like Relay or a high-yield business savings account to hold your tax reserves safely.

🧠 The Tax Pro Advantage

A tax professional can help you build a tailored tax plan — using advanced tools to project your exact quarterly and year-end tax targets.

That means no guesswork, no overpaying, and no “surprise bills” at the end of the year.

🗓 Step 2: Mastering Quarterly Taxes

If you’re self-employed, you must pay taxes as you earn income — not just once a year.

Quarterly payments keep you compliant and prevent IRS penalties.

🧾 Self-Employed (Schedule C) Agents Pay

Income tax (federal + state)

Self-employment tax (Social Security & Medicare) is 15.3% on top of income taxes.

Due dates: Apr 15 · Jun 15 · Sep 15 · Jan 15, I.E you make income during the quarter, you need to make an estimated tax payment at least equal to what you paid last year in total taxes, more on this below to avoid penalties.

🏢 S-Corp Owners Pay

Payroll: Taxes are taken monthly or semi-weekly on your “reasonable salary.” Also, to clarify, you essentially pay the 15.3% self-employment tax here, but it is part of payroll; the self-employment tax and payroll taxes exist to cover FICA (like social security, etc.). Income tax also applies here as well.

Distributions: Estimated income tax is paid quarterly on leftover business profits (distributions) you pay yourself with, which avoids the 15.3% self-employment tax and is only taxed based on income tax (this is what you pay quarterly on with your S-Corp, since payroll is covered when you receive a check). This is the true benefit of an S-Corp because a portion of your income can avoid the self-employed tax.

⚖️ Safe Harbor Rule (Don’t Miss This)

To avoid underpayment penalties, meet either test:

Pay 90% of your current year’s tax, or

Pay 100% of last year’s tax (110% if AGI > $150K, which means if you earned more than 150K in the previous year)

Even if income spikes mid-year, staying within safe harbor keeps you penalty-free.

Pro Tips:

To know your safe harbor on Form 1040 (personal tax return), look at line 24. This is your tax payment before credits and refunds. Even if you got money back, you must pay this number throughout the year to avoid a penalty.

S Corp owners, to know your safe harbor, depends on the state its in. Most states the taxes flow to your personal return so you just need to look at your 1040, but for example, in California, every company owes $800 or 1.5% of business income each tax year, so make sure you understand your state’s laws to follow their safe harbor rules.

🧰 Top Payroll Tools for Agents & S-Corps

Gusto → clean, automated payroll + tax filing

QuickBooks Payroll → perfect if you already use QBO

Both handle deposits and W-2/941 filings automatically — compliance without stress. Please do not do the payroll yourself; use a tool.

💵 Step 3: Cashflow & Survival Tips for a Seasonal Business

Real estate is not a steady-paycheck business — income swings with the market.

Smart agents build systems that survive slow months.

🪣 1. Build a “3 – 4 Month Survival Fund”

Keep 3 – 4 months of business + personal expenses in reserve.

If expenses = $5,000/mo → reserve = $15K – $20K.

This fund covers marketing, MLS fees, and personal bills when closings slow.

💳 2. Avoid “Early Commission” Loans

Commission-advance companies charge heavy fees (often 20 – 30%).

Instead, rely on your own reserves — your future self will thank you.

🔁 3. Automate Your Accounts

Set up three:

1️⃣ Operating – business income & expenses

2️⃣ Tax – 20 – 30% set-asides

3️⃣ Reserve – emergency + slow-season fund

Move tax money the day your commission hits. Treat it like rent — non-negotiable.

📈 4. Pay Yourself a Consistent “Salary”

Even if you’re not an S-Corp, pay yourself weekly, bi-weekly, monthly, quarterly. Pick one and make it consistent.

It builds predictability and helps with budgeting and loan qualifications.

🌦 5. Expect the Seasons

Most agents earn 60 – 70% of income between March and September.

Plan ahead:

Save extra during the busy season.

Keep marketing steady during Q4 – Q1.

Review taxes quarterly with your pro to adjust targets early.

🧭 Bottom Line

Your taxes aren’t scary when you control your cash flow.

Setting aside 20 – 30%, following safe-harbor rules, and building reserves gives you stability in an unpredictable business.

Treat your real estate income like a business, and your taxes become part of your wealth plan.

*📬 Commission Keeper

Helping agents master money, taxes, and long-term wealth.

For educational purposes only. Not legal or tax advice.* for exact advice send me an email at cameron@superdadtax.com or a call/text at 321-321-1901.