Should You Be An S Corporation?

A 2025 Guide for Real Estate Agents

Disclaimer: This article is for educational purposes only. It’s not personal tax or legal advice. Your situation is unique. Always consult with a qualified tax professional before deciding whether an S Corporation election is right for you.

An S-Corporation is a business entity commonly established to minimize tax liability. In short, it’s an entity that most small business owners — especially real estate agents — should consider if they want to maximize their tax benefits.

But here’s the catch: many don’t fully understand the difference between simply forming an LLC or corporation and actually electing S-Corp status for tax purposes. Even before I got into the tax business, I personally received bad advice from professionals who didn’t explain when an S-Corp makes sense. Unfortunately, this is more common than you’d think — even some tax advisors miss the mark on corporation elections.

That’s why it’s important not to rely solely on someone else’s judgment. As a business owner, you need to understand the basics yourself so you can make the best possible decision. Choosing the wrong structure or not electing at the right time could cost you thousands of dollars in unnecessary taxes every single year.

Why Taxes Hurt So Much as an Agent

If you’re a real estate agent, you probably know the sting of taxes. Here’s why:

As a sole proprietor (which most agents are when they start), you pay self-employment tax on all your net income, which currently is 15.3%.

You also pay 12.4% on Social Security and 2.9% on Medicare.

💡 Example: If you net $100,000 after expenses, you’ll owe about $15,300 in self-employment tax — before income tax. That’s money straight out of your pocket.

What an S Corp Does Differently

An S Corporation is a regular corporation or LLC that elects S-Corporation status, which tells the IRS:

“Tax me as a pass-through. Don’t tax me at the corporate level. Let income flow to my personal return.”

Here’s the magic for Realtors®

You must pay yourself a reasonable salary (through payroll, with W-2s and withholdings).

Any profit left after salary can be taken as a distribution.

Distributions are not subject to self-employment tax.

👉 That’s where the savings come in.

When an S Corp Makes Sense?

An S Corp isn’t for every agent; all numbers below are what you have in your business after yearly expenses:

If your net income after expenses is less than $40,000, the setup and payroll costs usually eat the savings.

Between $50,000 and $80,000, it may start to make sense.

Once you’re consistently netting $ 100,000 or more, it’s often worth serious consideration.

⚠️ Agent Tip: Think of it this way — if you can save more in taxes than it costs you to run payroll, file the S Corp return, and keep up compliance, it’s worth exploring. If not, keep it simple.

The “Reasonable Salary” Rule

The IRS doesn’t let you pay yourself $10,000 and call the rest a distribution. They require you to pay a reasonable salary based on:

What other agents in your market would earn in a similar role

Your duties and hours worked

Industry norms

💡 40/60 Rule of Thumb: Many tax pros suggest paying about 40–60% of your net income as salary and the rest as distributions. Example: If you net $100,000, a $60,000 salary and $40,000 distribution is often reasonable. It’s not official law, but it’s a safe guideline. Have I seen situations where distributions can be higher than above absolutely, but it's all situation-dependent.

⚠️ Pay too little → audit risk.

✅ Pay a fair salary → you’re in a safer zone

The Real Power Move: Retirement Savings

An S-Corp isn’t just about saving self-employment tax. It also unlocks bigger retirement contributions than you could make as a sole proprietor. Let’s look at two powerful options, but as always, consult your investment advisor:

Example 1: Roth IRA (After-Tax Growth)

2025 Limit: $7,000 per year ($8,000 if you’re age 50+)

How it works: Contributions are made after tax. That means no deduction now, but your money grows tax-free, and withdrawals in retirement are also tax-free.

Agent Example: If you earn $100,000 net income as an S-Corp owner, you could still contribute up to $7,000 into a Roth IRA (income phase-outs apply starting around $161,000 for single filers or $240,000 for joint filers in 2025).

👉 The Roth is about tax-free income later — great if you expect your retirement tax bracket to be higher.

Example 2: Solo 401(k) (Pre-Tax Contributions)

With an S-Corp, you’re both the employee and the employer. That means you can contribute on both sides:

Employee contribution (your W-2 salary): Up to $23,500 in 2025 ($30,000 if you’re 50+).

Employer contribution (your business): Up to 25% of your W-2 salary.

💡 Agent Example: Let’s say your S-Corp pays you a salary of $100,000.

Employee side: $23,500 (pre-tax, reduces your taxable income now).

Employer side: $25,000 (25% of the $ 100,000 salary).

Total contribution = $48,500 in 2025.

That’s seven times more than a Roth IRA alone.

Example 3: Combining Roth IRA + Solo 401(k)

Roth IRA (after tax): $7,000

Solo 401(k) (pre-tax): $48,500

Combined = $55,500 in retirement savings for 2025

Tax Savings From the Solo 401(k)

If you contribute the full $48,500 pre-tax into a Solo 401(k) and you’re in the 22% federal bracket, you could save about $10,670 in federal taxes this year — plus reduce your adjusted gross income (AGI), which may help with other deductions and credits.

👉 Agent Tip: The Roth IRA gives you tax-free money later, while the Solo 401(k) gives you tax savings today (plus the potential for massive compound growth). Many agents use both strategies to balance their tax bill now and in retirement.

Don’t Forget the 199-A Deduction.

The Qualified Business Income (QBI) deduction under current law allows many small business owners to deduct up to 20% of their qualified business income.

For agents, this means:

Your distributions (the part not subject to payroll tax) may qualify for this deduction.

Balancing salary vs. distributions properly can maximize both tax savings on SE tax and the QBI deduction.

High earners: once your taxable income goes above the IRS thresholds (around $383,900 for married filing jointly in 2025), the deduction phases out.

👉 Translation: The S Corp strategy isn’t just about payroll tax savings — it’s also about positioning yourself to take advantage of this 20% deduction when possible.

The Responsibilities (Don’t Skip These)

Running an S Corp comes with rules:

Run payroll → paychecks, withholdings, file quarterly IRS payroll forms (941), and W-2s at year end.

File Form 1120-S each year and issue K-1s to yourself.

File annual reports with your state.

Keep a separate business bank account and track all expenses. (You should already do this when you're just self-employed)

Stay on top of deadlines — missing filings risks penalties or even loss of S Corp status.

The Bottom Line for Agents

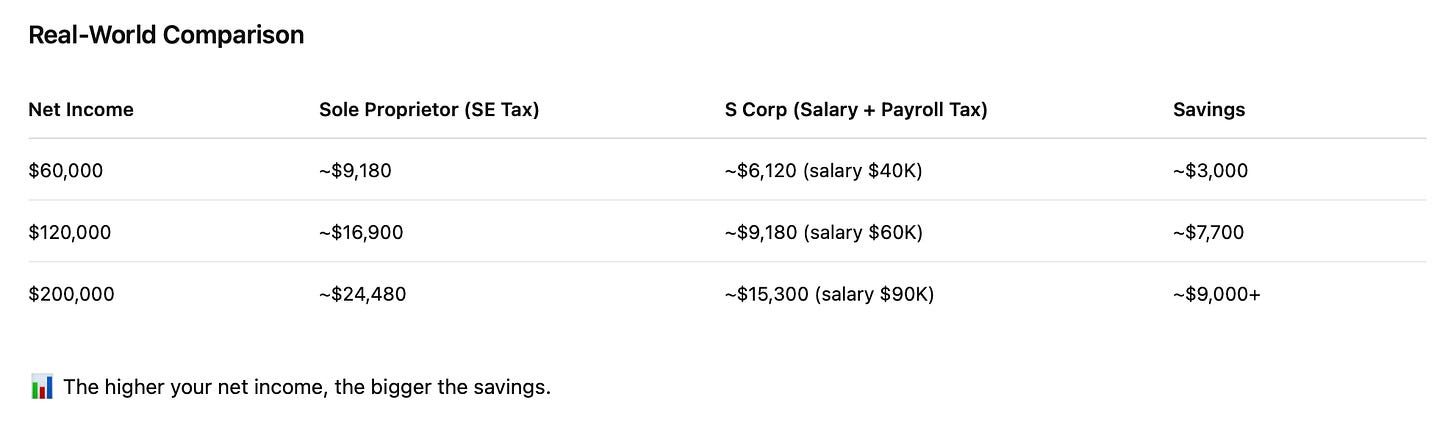

S Corps save money by cutting self-employment tax — especially as your income grows.

They unlock bigger retirement contributions, helping you keep more and build wealth.

They may also help you maximize the 199-A deduction if you structure things correctly.

But they require discipline and compliance.

If you’re hitting consistent six figures and you feel the tax pinch, an S Corp could be the most brilliant move you make this year.

👉 Just don’t DIY this. Partner with a tax professional who understands real estate agents and can help you decide if this is right for you today.